Naukri.com is committed to protecting the data provided to us by our users and increasing the security of our customer accounts.

The New KYC Update Process for Clients: A Guide

KYC, or Know Your Customer, is a crucial process for Naukri to verify the identity of it’s clients. With the updated KYC process, clients can now complete the verification process online, making it more convenient and efficient.

This blog will guide you through the new KYC process for:

- Individual or proprietorship firms

- Company or partnership firms

and answer some of the frequently asked questions.

Know Your Customer (KYC) requirement will enable us to know / understand our customers better, and to-

- protect your account information and identity

- prevent misuse of the personal information of jobseekers, which you are privy to

- protect our users from being victims of fraud

This includes verifying the identity and address of customers. KYC documents approval is needed before activation of any new subscription. In case of non-compliance, newly purchased subscriptions will not be activated for use.

New KYC Process for Individual or Proprietorship Firms

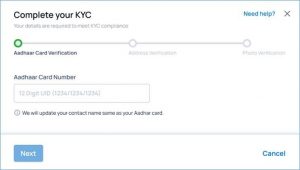

Step 1 – Aadhar Verification via OTP

- Enter your Aadhaar number.

- An OTP will automatically be sent to the Aadhaar registered mobile number.

- Enter the correct OTP to successfully verify this step.

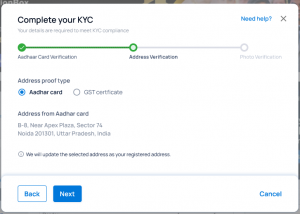

Step 2 – Address Verification

- Confirm the address that is fetched from your Aadhaar Card or

- Upload a GST certificate to opt for an alternative address

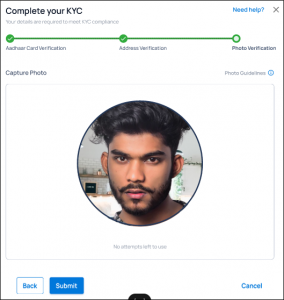

Step 3 – Photo Verification

- Click a selfie and submit it.

- The selfie will be automatically matched with the image on your Aadhaar card.

- If the images match, the verification will be complete.

Process for Company or Partnership firms:

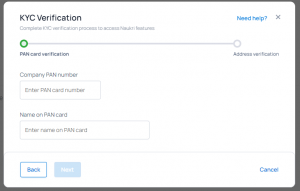

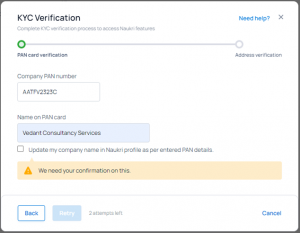

Step 1 – Company Registered PAN Card

1. Enter company name and company PAN number. Same is matched with government site for auto approval.

2. In case company name entered is different from registered company name, system will ask for consent for “auto updation”

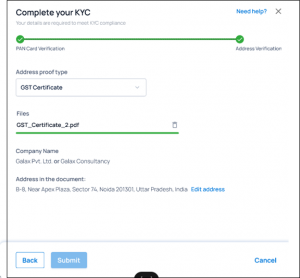

Step 2 – Address Verification

- Upload COI or GST documents for auto/instant verification to avoid the manual queue

- The company name in this step should be same as previous PAN step in which case user passes and KYC gets auto verified

- In cases where document scan fails after 2-3 attempts, user can submit the document and same will be verified manually in 2-3 days’ time

FAQs

FAQS –

Q. What if my document is correct but system is not able to scan

a. We have eliminated document at all possible steps except at address step for company case

b. In case system scan fails at address step (GST or COI upload step) – then we ask user to do 2-3 retries post which they can proceed for manual flow

c. Their verification will not be instant but still manual team will take this up and clear your case in maximum 2 working days TAT period

Q. My document is correct but scan is incorrect . I am not able to proceed what should I do?

a. In case of torn documents, old documents it may happen in very rare scenario that scanner scans wrong or incomplete data

b. In such cases we would request you to right to kyc@naukri.com and we will help you to manually proceed in such cases

Q: What should I do if my Aadhaar number is not linked to my mobile number?

A: Send an email to kyc@naukri.com with details about your issue. Our manual team will reply to you and help you cross this step. They may ask for additional documents to verify your identity.

Q: What if the image in my Aadhaar card doesn’t match my live selfie?

A: If the system detects a mismatch, it will prompt manual verification. After 2-3 attempts, the system will move your verification to our manual team, who will reach out to you for clarification via email.

Q: What happens if the scan fails anywhere during the process?

A: The system will provide you with multiple attempts and guide you through the process with manual information to help you move ahead.

Q: What if I don’t want to use my address from the documents provided in the address step?

A: Email kyc@naukri.com with the address document you wish to use. Our manual team will reply to you and help you verify your address.

Q: What if I am unable to complete the KYC process online?

A: You can reach out to kyc@naukri.com for manual verification at any stage of the process.